Question

Paradox of thrift Consider a hypothetical closed economy in which there are no income taxes. If households spend $0.80 of each additional dollar they earn and save the remainder, the expenditure multiplier for this economy is

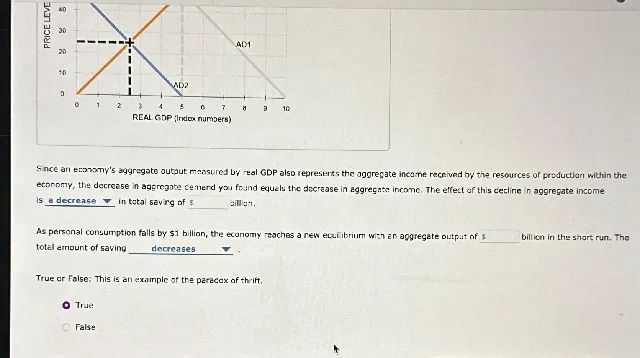

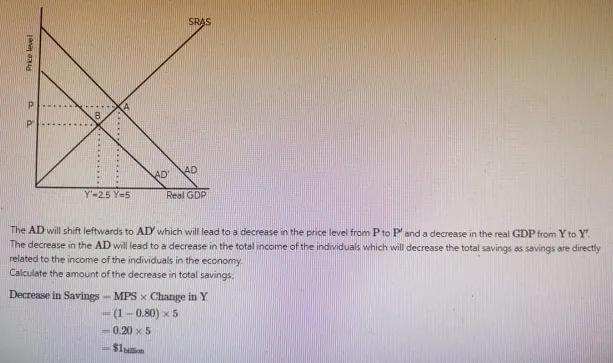

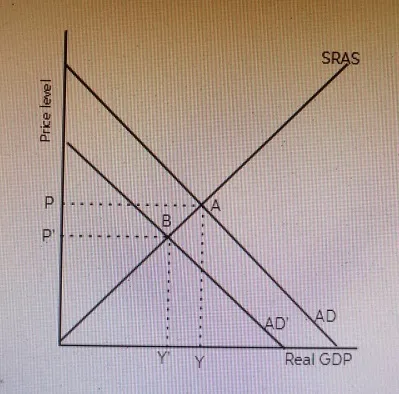

The following graph shows the initial aggregate demand (

AD)

and short-

run aggregate supply (

SRAS)

curves of this economy.

Suppose that the economy is currently in a recession. Business firms are pessimistic about the future and do not respond to a fall in interest rates. I addition, all households are pessimistic about job prospects and desire to consume less and save more at all levels of income. As a result, personal consumption in this economy decreases by $1

billion.

The reduction in personal consumption will lead to a decrease in aggregate demand by $5.0

billion.

Shift either the AD curve or the SRAS curve, or both, to show the new aggregate demand curve after the full impact of the multiplier process of the reduction in personal consumption has taken place.

Since an economy’s aggregate output measured by real GDP also represents the aggregate income received by the resources of production within the economy, the decrease in aggregate demand you found equals the decrease in aggregate income. The effect of this decline in aggregate income is a decrease grad in total saving of billion.

As personal consumption falls by $1

billion, the economy reaches a new equilibrium with an aggregate output of total amount of saving billion in the short run. The

True or False: This is an example of the paradox of thrift.

True

False

Answer

Step 1

Aggregate demand (AD) and aggregate supply (AS) are principles used in macroeconomics to understand the behavior of the overall financial system. They represent the entire demand and overall supply of goods and offerings in an economic system at a given price range and time. AD refers to the full amount of goods and services that families, agencies, authorities, and foreign buyers are inclined to purchase at various fee degrees in a given duration. AS represents the full amount of products and services that manufacturers in a financial system are inclined to supply at numerous price levels.

Explanation:

AD and AS evaluation facilitates policymakers to check the general health and balance of an economy. By inspecting the equilibrium between AD and AS, policymakers can discover ability imbalances and take corrective actions to preserve stability. Changes in AD and AS impact the general price level in an financial system.

Step 2

Savings declined by $1 billion.

In the short run, the aggregate output in the economy will decrease to $2.5 billion and the amount of savings will remain unchanged in the short run.

The scenario is an example of the paradox of thrift because, with the decrease in personal consumption, the amount of savings remains the same or unchanged.

Explanation:

The paradox of thrift highlights the potential conflict between individual decisions to keep greater and the general effect on aggregate demand within the economy. When people together decide to save more by lowering consumption, it can lead to a decrease in common spending and demand for items and services.

Answer

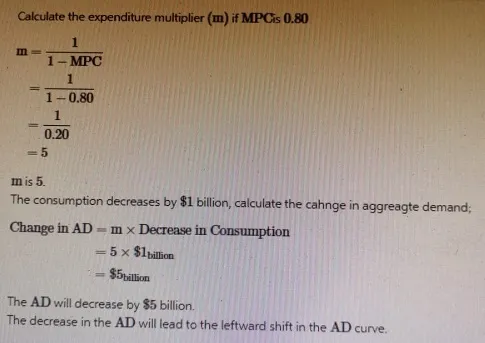

Expenditure multiplier is 5.

The AD will decrease by $5 billion.

The graph of a shift in AD curve

The decrease in AD will lead to a decrease in the total income of the individuals, which will decrease the total savings by $1 billion.

In the short run, the aggregate output will decrease by $2.5 billion and the savings will remain unchanged.

The scenario is true for the paradox of thrift.

Table of Contents

Exploring the Paradox of Thrift: Impact on Aggregate Demand and Economic Equilibrium

The paradox of thrift is a fascinating economic theory that challenges conventional wisdom about saving and consumption. It posits that while saving is generally considered a virtue for individuals, if everyone in an economy increases their savings simultaneously, it can lead to a decrease in overall economic activity, potentially triggering a recession. This article delves into the paradox of thrift, examining its impact on aggregate demand and economic equilibrium, with a focus on a hypothetical closed economy with no income taxes.

Introduction

The concept of the paradox of thrift was popularized by the economist John Maynard Keynes during the Great Depression. It highlights the counterintuitive relationship between individual savings and overall economic health. In essence, while saving is beneficial for individuals to secure their future, if everyone decides to save more and spend less, aggregate demand falls, leading to lower production, income, and ultimately, economic contraction.

In a hypothetical closed economy, where households save a portion of their income and there are no income taxes, the paradox of thrift can be observed in a striking manner. This article explores how changes in household consumption and savings behavior impact aggregate demand and economic equilibrium, using a detailed example.

Understanding the Economic Model

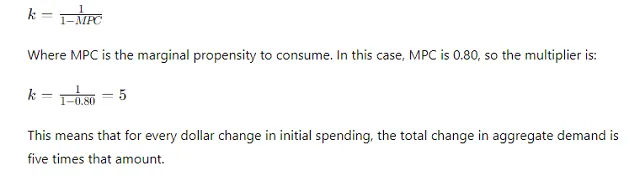

The Expenditure Multiplier

In our hypothetical economy, households spend 80% ($0.80) of each additional dollar they earn and save the remaining 20% ($0.20). This spending behavior leads to an expenditure multiplier, which determines the total impact of a change in spending on the economy. The expenditure multiplier (k) can be calculated using the formula:

Initial Economic Conditions

Let’s consider the initial aggregate demand (AD) and short-run aggregate supply (SRAS) curves in our economy. Suppose the frugality is presently in a recession. Business enterprises are pessimistic about the future and don’t respond to falling interest rates. contemporaneously, homes are pessimistic about job prospects and decide to consume lower and save more at all situations of income.

Impact of Reduced Consumption

Decrease in Personal Consumption

Assume personal consumption decreases by $1 billion due to household pessimism. Given the expenditure multiplier of 5, the total decrease in aggregate demand will be:

This significant reduction in aggregate demand will shift the AD curve to the left. The new AD curve represents the reduced demand at every price level, reflecting the full impact of decreased personal consumption and the multiplier effect.

Effect on Economic Equilibrium

In an economy, aggregate output measured by real GDP also represents the aggregate income received by the resources of production. thus, a drop in aggregate demand equals a drop in aggregate income. As aggregate income falls, total savings also decline, as people have less income to save.

In the short run, as personal consumption falls by $1 billion, the economy reaches a new equilibrium with lower aggregate output and savings. This outcome exemplifies the paradox of thrift, where increased individual saving intentions lead to a decrease in overall economic activity and savings.

Conclusion

The paradox of thrift demonstrates a crucial insight into macroeconomics: individual actions that are beneficial on a microeconomic level can have unintended negative consequences when aggregated across the entire economy. In our hypothetical closed economy, the desire to save more during a recession leads to a significant decrease in aggregate demand, resulting in lower economic output and income.

Understanding the paradox of thrift is vital for policymakers and economists as they design strategies to stabilize and stimulate the economy. By recognizing the potential adverse effects of widespread increases in saving, they can implement measures to encourage spending and investment, thereby boosting aggregate demand and fostering economic growth.

The paradox of thrift reminds us that the dynamics of an economy are complex and interconnected, requiring a delicate balance between saving and spending to achieve optimal economic equilibrium.